UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14-A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨o

Check the appropriate box:

| ¨o | Preliminary Proxy Statement |

| ¨o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨o | Definitive Additional Materials |

| ¨o | Soliciting Material Under Rule l4a-l2 |

STANDARD MOTOR PRODUCTS, INC.

(Name of Registrant as Specified In Itsin its Charter)

| N/A |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

¨o | Fee computed on table below per Exchange Act Rules l4a-6(i)(4)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

¨o | Fee paid previously with preliminary materials. |

¨o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

STANDARD MOTOR PRODUCTS, INC.

37-18 Northern Blvd.

Long Island City, New York 11101

April 19, 201115, 2014

To Our Stockholders:Stockholders:

You are cordially invited to attend the Annual Meeting of Stockholders of Standard Motor Products, Inc. to be held at the offices of JPMorgan Chase, 277Kelley Drye & Warren LLP, 101 Park Avenue, New York, NY 10172,10178, on Thursday, May 19, 201115, 2014 at 2:4:00 p.m. (Eastern Daylight Time).

At the Annual Meeting, you will be asked to: (a) elect nineten directors; (b) approve amendments to the Standard Motor Products, Inc. 2006 Omnibus Incentive Plan; (c) ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for our 20112014 fiscal year; (d)and (c) consider and vote upon a non-binding, advisory resolution approving the compensation of our named executive officers; and (e) consider and vote upon a non-binding, advisory proposal as to the frequency (every one, two or three years) with which non-binding stockholder votes to approve the compensation of our named executive officers should be conducted in the future.officers.

The formal notice of the Annual Meeting, the Proxy Statement and the Proxy Card are enclosed. We have also enclosed a copy of our Annual Report to Stockholders, which includes our Form 10-K for our 20102013 fiscal year.

YOUR VOTE IS IMPORTANT! The Board of Directors appreciates and encourages stockholder participation in the Company’s affairs and invites you to attend the Annual Meeting in person. It is important, however, that your shares be represented at the Annual Meeting, and for that reason, we ask that whether or not you expect to attend the Annual Meeting, you take a moment to complete, sign, date sign and return the accompanying proxy in the enclosed postage-paid envelope.envelope, or to transmit your voting instructions via the Internet or by telephone. Unless you provide specific instructions as to how to vote, brokers may not vote your shares in connection with the election of directors the proposed amendments to the 2006 Omnibus Incentive Plan,or the advisory vote on the compensation of our named executive officers, or the advisory proposal regarding the frequency of future non-binding stockholder votes to approve the compensation of our named executive officers.

On behalf of the Board of Directors, I would like to thank you for your continued support of the Company. I look forward to seeing you at the Annual Meeting.

| Sincerely, |

| | |

| |

| Lawrence I. Sills |

| Chairman of the Board and |

| Chief Executive Officer |

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on May 19, 2011—15, 2014—this Proxy Statement and the Annual Report are available at www.smpcorp.com under “Investor Relations—Financial Reporting—Proxy Statements” and “—Annual Reports”.

STANDARD MOTOR PRODUCTS, INC.

37-18 Northern Blvd.

Long Island City, New York 11101

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 19, 201115, 2014

To Our Stockholders:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of STANDARD MOTOR PRODUCTS, INC. (the “Company”) will be held at the offices of JPMorgan Chase, 277Kelley Drye & Warren LLP, 101 Park Avenue, New York, NY 10172,10178, on Thursday, May 19, 201115, 2014 at 2:4:00 p.m. (Eastern Daylight Time). The Annual Meeting will be held for the following purposes:

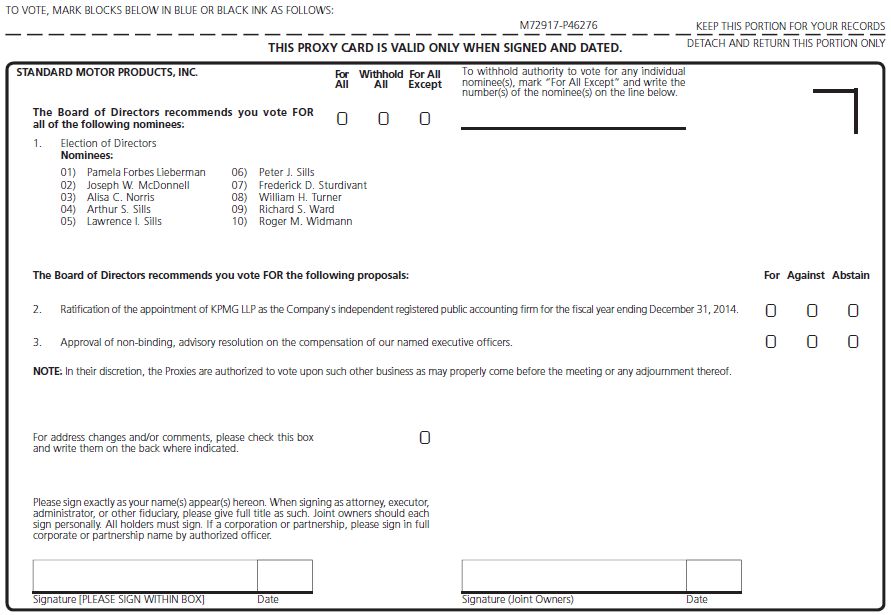

| 1. | To elect nineten directors of the Company, all of whom shall hold office until the next annual meeting of stockholders and until their successors are duly elected and qualified; |

| 2. | To approve amendments to the Standard Motor Products, Inc. 2006 Omnibus Incentive Plan; |

| 3. | To ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2011;2014; |

| 4.3. | To consider and vote upon a non-binding, advisory resolution approving the compensation of our named executive officers; |

| 5. | To consider and vote upon a non-binding, advisory proposal as to the frequency (every one, two or three years) with which non-binding stockholder votes to approve the compensation of our named executive officers should be conducted in the future; and |

| 6.4. | To transact such other business as may properly come before the Annual Meeting. |

The foregoing items of business are more fully described in the proxy statementProxy Statement accompanying this notice.Notice. The Board of Directors has fixed the close of business on April 8, 20114, 2014 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting or any adjournment thereof.

Whether or not you plan to attend the Annual Meeting, please vote dateyour shares by using the Internet or telephone to transmit your voting instructions, or by completing, signing and signdating the enclosed proxy, which is solicited by the Board of Directors of the Company, and return itthe proxy in the pre-addressed envelope, to which no postage need be affixed if mailed within the United States.

| By Order of the Board of Directors |

| |

|  |

| Carmine J. Broccole |

| Vice President General Counsel |

| and Secretary |

Long Island City, New York

April 19, 2011

STANDARD MOTOR PRODUCTS, INC.

37-18 Northern Blvd.

Long Island City, New York 11101

Title | | Page No. |

| | |

| | 1 |

| | |

| | 1 |

| | |

| | 34 |

| | |

| | 7 |

| | |

Proposal 3 — Ratification of KPMG LLP | | 169 |

| | |

| | 1810 |

| | |

Proposal 5 — Advisory Vote on the Frequency of a Stockholder Vote on the Compensation of our Named Executive Officers | | 19 |

| | |

| | 2111 |

| | |

| | 2313 |

| | |

| | 2313 |

| | |

| | 3122 |

| | |

Executive | | 3325 |

| | |

| | 4639 |

| | |

| 40 |

| |

| | 5750 |

| | |

| | 5851 |

| | |

| | 5851 |

| | |

| | 5952 |

STANDARD MOTOR PRODUCTS, INC.

37-18 Northern Blvd.

Long Island City, New York 11101

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 19, 201115, 2014

This proxy statementProxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Standard Motor Products, Inc. (the “Company”) for use at the Annual Meeting of Stockholders of the Company to be held on May 19, 201115, 2014 or at any adjournment thereof. Proxy material is first being mailed on or about April 19, 2011.15, 2014.

The specific proposals to be considered and acted upon at the Annual Meeting are summarized in the accompanying Notice of Annual Meeting of Stockholders. Each proposal is described in more detail in this proxy statement.Proxy Statement.

VOTING RIGHTS AND SOLICITATION

Information as to Voting Securities

The close of business on April 8, 20114, 2014 has been fixed by the Board of Directors as the record date for the determination of stockholders entitled to notice of, and entitled to vote at, the Annual Meeting. The total number of shares of Common Stock outstanding and entitled to vote on April 8, 20114, 2014 was 22,843,742.23,399,105. Holders of Common Stock have the right to one vote for each share registered in their names on the books of the Company as of the close of business on the record date.

In order to conduct business at the Annual Meeting, our By-laws require the presence in person or by proxy of stockholders holding a majority of the voting power of the outstanding shares of Common Stock entitled to vote on the matters presented at the Annual Meeting. If a quorum is not present, a vote cannot occur, and our Annual Meeting may be adjourned to a subsequent date for the purpose of obtaining a quorum. Proxy cardsProxies received by us but markedvoted as “Withheld,” abstentions and broker non-votes will be included in the calculation of the number of shares considered in determining whether or not a quorum exists. Broker non-votes are shares that are held in “street name” by a bank, or brokerage firm or other holder of record that indicates on its proxy that it does not have or did not exercise discretionary authority to vote on a particular matter.

Under the current rules of the New York Stock Exchange, or NYSE, if you do not give instructions to your brokerage firm, it will still be able to vote your shares with respect to certain “routine matters,” but will not be allowed to vote your shares with respect to certain “non-routine matters”.matters.” The ratification of KPMG LLP as our independent registered public accounting firm (Proposal No. 3)2) is considered to be a routine matter under the NYSE rules, and your brokerage firm will be able to vote on that item even if it does not receive instructions from you, so long as it holds your shares in its name. However, the election of directors (Proposal No. 1), the approval of the amendments to the Standard Motor Products, Inc. 2006 Omnibus Incentive Plan (Proposal No. 2), and the advisory resolution to approve the compensation of our named executive officers (Proposal No. 4), and the advisory proposal as to the frequency of future non-binding stockholder votes to approve the compensation of our named executive officers (Proposal No. 5),3) are “non-routine matters”.matters.” Your broker will not be able to vote your shares with respect to these non-routine matters if you have not provided instructions to your broker, and those votes will be counted as broker non-votes. Broker non-votes are not counted or deemed to be present or represented for the purpose of determining whether stockholders have approved a proposal. We strongly encourage you to submit your proxy card and exercise your right to vote as a stockholder.

Voting and Revocation of Proxies

You can vote your shares by completing and returning a proxy card, or by voting in person. If you holdperson or by using the Internet or telephone to transmit your shares in “street name,” you should provide your broker or other nominee with voting instructions to ensure that your shares are voted.instructions.

To Vote by Mail: Complete, sign, date and return your proxy card in the pre-addressed envelope, to which no postage need be affixed if mailed within the United States. The persons named in the accompanying form of proxy will vote the shares represented thereby, as directed in the proxy, if the proxy appears to be valid on its face and is received by the time of the Annual Meeting.

To Vote in Person: Attend the Annual Meeting, or send a personal representative with an appropriate proxy, to vote by ballot.

To Vote by Internet: Go to the website listed on time. your proxy card to vote via the Internet. You will need to follow the instructions on your proxy card and the website.

To Vote by Telephone: Call the telephone number on your proxy card to vote by telephone. You will need to follow the instructions on your proxy card and the voice prompts.

If you vote via the Internet or by telephone, your electronic vote authorizes the named proxies to vote on your behalf in the same manner as if you completed, signed, dated and returned your proxy card. If you vote via the Internet or by telephone, you do not need to return your proxy card.

If you hold your shares in “street name,” you will receive instructions from the holder of record that you must follow in order to have your shares voted. The instructions from the holder of record will indicate if Internet and telephone voting are available, and if they are available, will provide details as to how to vote by such means.

With respect to the election of directors, stockholders may (a) vote in favor of all nominees, (b) withhold their votes as to all nominees, or (c) withhold their votes as to specific nominees. With respect to Proposals No. 2 3 and 4,3, stockholders may vote For or Against the proposal or Abstain from voting with respect to the proposal. With respect to Proposal No. 5, stockholders may vote for a frequency of 1 year, 2 years, or 3 years, or may Abstain from voting on the proposal. Stockholders should specify their choices on the accompanying proxy card.when voting their shares. In the absence of specific instructions, proxies so received will be voted: (1) “FOR” the election of all of the named nominees to the Company’s Board of Directors; (2) “FOR” the amendments to the Standard Motor Products, Inc. 2006 Omnibus Incentive Plan; (3) “FOR” the ratification of KPMG LLP as the Company’s independent registered public accounting firm; (4)(3) “FOR” the advisory resolution approving the compensation of our named executive officers; (5) for a frequency of every “THREE YEARS” for future non-binding stockholder advisory votes on the compensation of our named executive officers; and (6)(4) in accordance with the best judgment of the individuals named as proxies on the proxy card on any other matters properly brought before the meeting.

Proxies are revocable at any time before they are exercised. Whether you voted by mail, via the Internet or by telephone, you may revoke your proxy before it is exercised by (a) sending incompleting and returning a timely and later-dated proxy card (with the same or other instructions), or using the Internet or telephone to timely transmit your later voting instructions, (b) appearing at the Annual Meeting and voting in person, or (c) notifying Carmine J. Broccole, Secretary of the Company, that the proxy is revoked via fax at 718-784-3284, or via mail to 37-18 Northern Blvd., Long Island City, NY 11101, or via email at financial@smpcorp.com. financial@smpcorp.com.

If you hold shares through a bank or brokerage firm,in “street name,” you must contact that bank or firmthe holder of record to revoke any prior voting instructions.

Nominees receiving a plurality of the votes cast will be elected as directors. Approval of each of Proposals No. 2 3 and 43 requires that the votes cast in favor of the respective proposal exceed the number of votes cast against the proposal. For Proposal No. 5, the frequency for future non-binding advisory votes on executive compensation receiving the greatest number of votes — every year, every two years or every three years — will be the frequency that stockholders approve. However, with respect to ProposalsProposal No. 4 and 5,3 because your vote is advisory, it will not be binding on the Board or the Company, but the Board will review the voting results and take them into consideration when making future decisions regarding executive compensation and the frequency of the advisory vote on the compensation of our named executive officers.compensation. Only those votes cast “FOR” or “AGAINST” a proposal and for a frequency period regarding advisory votes on the compensation of our named executive officers are used in determining the results of a vote. An abstention or a broker non-vote shall not constitute a vote cast.

Method and Expense of Proxy Solicitation

The solicitation of proxies will be made primarily by mail. Proxies may also be solicited personally and by telephone by employees of the Company at nominal cost.

The Company does not expect to pay compensation for any solicitation of proxies, but may pay brokers and other persons holding shares in their names, or in the name of nominees, their out-of-pocket and reasonable clerical expenses for sending proxy material to beneficial owners for the purpose of obtaining their proxies. The Company will bear all expenses in connection with the solicitation of proxies.

At the Annual Meeting, nineten directors are to be elected to hold office until the next annual meeting of stockholders and until their successors are duly elected and qualified. Unless individual stockholders specify otherwise, each executed proxy will be voted “FOR” the election to the Board of Directors of the nineten nominees named below, all of whom are currently directors of the Company.

Information Regarding Nominees

The following paragraphs provide information, as of the date of this proxy statement,Proxy Statement, about each nominee. The information includes each director’s age, all positions they hold, their principal occupation and business experience for at least the past five years, and the names of other publicly-held companies of which they currently serve as a director or for which they have served as a director at any time during the past five years. In addition to the information presented below regarding each nominee’s specific experience, qualifications, attributes and skills that led our Board to the conclusion that he or she should serve as a director, we also believe that all of our director nominees have a reputation for integrity, honesty and adherence to high ethical standards. They each have demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment to serve the Company and our Board. Finally, we value their significant experience on other public company boards of directors and board committees.

Each person listed below has consented to be named as a nominee and agreed to serve if elected. If any of those named are not available for election at the time of the Annual Meeting, discretionary authority will be exercised to vote for substitutes unless the Board chooses to reduce the number of directors. Management is not aware of any circumstances that would render any nominee listed below unavailable.

| Name of Director | | Position with the Company | | Age | | Director Since | | Position with the Company | | Age | | Director Since |

| Lawrence I. Sills | | Chairman of the Board and Chief Executive Officer | | 71 | | 1986 | | Chairman of the Board and Chief Executive Officer | | 74 | | 1986 |

William H. Turner(1)(2) | | Presiding Independent Director | | 71 | | 1990 | | Presiding Independent Director | | 74 | | 1990 |

Robert M. Gerrity(1)(3) | | Director | | 73 | | 1996 | |

Pamela Forbes Lieberman(1)(5) | | Director | | 57 | | 2007 | |

Pamela Forbes Lieberman(1)(5)(6) | | | Director | | 60 | | 2007 |

Joseph W. McDonnell(1) | | | Director | | 62 | | 2012 |

Alisa C. Norris(1)(5) | | | Director | | 44 | | 2012 |

| Arthur S. Sills | | Director | | 67 | | 1995 | | Director | | 70 | | 1995 |

| Peter J. Sills | | Director | | 64 | | 2004 | | Director | | 67 | | 2004 |

Frederick D. Sturdivant(1)(5) | | Director | | 73 | | 2001 | |

Frederick D. Sturdivant(1)(5)(6) | | | Director | | 76 | | 2001 |

Richard S. Ward(1)(4) | | Director | | 70 | | 2004 | | Director | | 73 | | 2004 |

Roger M. Widmann(1)(5)(6) | | Director | | 71 | | 2005 | |

Roger M. Widmann(1)(3)(5) | | | Director | | 74 | | 2005 |

| | (1) | Member of the Audit Committee, Compensation and Management Development Committee, and Nominating and Corporate Governance Committee. |

| | (2) | Chairman of the Audit Committee. |

| | (3) | Chairman of the Compensation and Management Development Committee. |

| | (4) | Chairman of the Nominating and Corporate Governance Committee. |

| (5) | Member of the Strategic Planning Committee. |

| (6) | ChairmanCo-Chairperson of the Strategic Planning Committee. |

Lawrence I. Sills has served as our Chairman of the Board and Chief Executive Officer since December 2000 and has been a director of the Company since 1986. From 1986 to 2000, Mr. Sills served as our President and Chief Operating Officer. From 1983 to 1986, he served as our Vice President of Operations. Mr. Sills is the brother of Arthur S. Sills and Peter J. Sills, each a director of the Company, and is the father of Eric Sills, our Vice President Engine Management Division.Global Operations. Mr. Sills holds an MBA from Harvard Business School and a BA from Dartmouth College.

We believe Mr. Sills’ qualifications to serve as a director and our Chairman of the Board include his wealthwealth of experience and the business understanding that Mr. Sills has obtained from over 40 years of working in various capacities at the Company and in the automotive industry. Mr. Sills’ knowledge of all aspects of the Company’s business and its history, position him well to serve as our Chairman and Chief Executive Officer. In addition, we believe Mr. Sills’ qualifications to sit on our Board include his and his family’s significant ownership interest in the Company, which serves to align his interests with the interests of our other stockholders, and the fact that he represents the third generation of the Sills family which established the Company in 1919.

William H. Turner has served as our Presiding Independent Director since January 2006 and as a director of the Company since May 1990. He also serves as a director of Ameriprise Financial, Inc. and Volt Information Sciences, Inc. Formerly, Mr. Turner served as a director of Franklin Electronic Publishers, Inc. and New Jersey Resources Corporation. Since 1985, he has served as the Chairman of the International College, of Beirut, Lebanon and, from June 2008 to January 2010, as Acting Dean of the Business School at Montclair State University. From 2004 to 2008, Mr. Turner was the Dean of the College of Business at Stony Brook University. Mr. Turner served as the Senior Partner of Summus Ltd., a consulting firm, from 2002 to 2004. From 1997 to 2002, he served in various capacities at PNC Bank NJ, including President, Chief Executive Officer and Chairman Northeast Region. He was President and Co-Chief Executive Officer of Franklin Electronic Publishers, Inc. from 1996 to 1997. Prior to that time, he was the Vice Chairman of Chase Manhattan Bank and its predecessor, Chemical Banking Corporation. Mr. Turner completed the Advanced Management Program from Harvard Business School, and he holds an MBA from New York University and a BA from Trinity College.

We believe Mr. Turner’s qualifications to serve as a director and our Presiding Independent Director include his extensive executive leadership and financial and managerial experience. His service as Chief Executive Officer and Vice Chairman at several banking institutions make him a valuable asset to our Board, and has provided him with a wealth of knowledge in dealing with financial and accounting matters. The depth and breadth of his exposure to complex financial issues at other large corporations, as well as the deep understanding of our Company that he has acquired in two decades of service on our Board, make him a valuable advisor.

Robert M. Gerrity has served as a director of the Company since July 1996. Mr. Gerrity also serves as a director of Rimrock Corporation and Polyair Inter Pack Inc. Mr. Gerrity is the Chairman of the Industrial Group of Glencoe Capital, a private equity firm, and is a director and principal of Gerrity Partners, a Board consulting business. Formerly, he served as a director of Federal Signal Corporation, Birmingham Steel Corporation, Joy Global Inc. (formerly Harnischfeger Industries), Libralter Engineering Systems, Rubbermaid Corporation, and New Holland n.v. Prior to 1995, he served in a variety of manufacturing, engineering and management positions with the Ford Motor Company including Chief Executive Officer of Ford New Holland and Ford of Brazil.

We believe Mr. Gerrity’s qualifications to serve as a director include his extensive business experience, including serving as Chief Executive Officer with global companies, such as Ford Motor Company. Mr. Gerrity has a unique perspective to offer the Board on a variety of automotive-related issues. His experience serving on the governance, audit and compensation committees (including as chairman) of several public companies and his knowledge of restructuring, mergers and acquisitions also provide valuable insight to our Board.

Pamela Forbes Lieberman has served as a director of the Company since August 2007. Ms. Forbes Lieberman also serves as a director of A.M. Castle & Co. and VWR Funding, Inc. and serves as a member of the advisory board of WHI Capital Partners, a private equity firm. From March 2006 to August 2006, Ms. Forbes Lieberman served as Interimthe interim Chief Operating Officer of Entertainment Resource, Inc. Prior to such time, Ms. Forbes Lieberman also served as President and Chief Executive Officer and member of the Board of Directors of TruServ Corporation (now known as True Value Company) from November 2001 to November 2004,and as TruServ’s Chief Operating Officer and Chief Financial Officer from July 2001 to November 2001, and as TruServ’s Chief Financial Officer from March 2001 to June 2001.Officer. Prior to March 2001,such time, Ms. Forbes Lieberman held Chief Financial Officer positions at ShopTalk Inc., The Martin-Brower Company, LLC, and Fel-Pro, Inc. and served as an automotive industry consultant from 1998 to 1999.consultant. Ms. Forbes Lieberman, is a Certified Public Accountant.Accountant, began her career at PricewaterhouseCoopers LLP. Ms. Forbes Lieberman holds an MBA from Kellogg School of Management, Northwestern University, and a BS from the University of Illinois.

We believe Ms. Forbes Lieberman’sLieberman’s qualifications to serve as a director include her years of executive experience, including serving as Chief Executive Officer, Chief Operating Officer and Chief Financial Officer for distribution and automotive companies. She brings demonstrated management ability at senior levels to the Board and insights into the operational requirements of a large company. In addition, her knowledge of public and financial accounting matters, logistics, and business strategy provides valuable insight to our Board.

Joseph W. McDonnell has served as a director of the Company since October 2012. Mr. McDonnell also serves as the Dean of the College of Management and Human Service at the University of Southern Maine, which includes the Schools of Business, Education, Social Work and Public Service. Mr. McDonnell previously served as the Interim Dean of the College of Business at Stony Brook University and was the President and Chief Executive Officer of the New York International Commerce Group, Inc., which provides services for companies doing business in China. Mr. McDonnell holds an Executive Program Certificate from Harvard Business School, a PhD in Communications from the University of Southern California, and an MA and BA from Stony Brook University.

We believe Mr. McDonnell’s qualifications to serve as a director include his significant experience in academics focusing on business administration and the development of management-level personnel, as well as the various leadership positions he held at foreign and domestic companies prior to becoming an academic administrator. His expertise in doing business in China and in consulting management on various strategic initiatives provides valuable insight to our Board.

Alisa C. Norris has served as a director of the Company since October 2012. Ms. Norris also serves as the Chief Marketing Officer of R.R. Donnelley & Sons Company, a global provider of communications solutions. Prior to joining R.R. Donnelley in April 2013, Ms. Norris served as the Chief People Officer of Opera Solutions, LLC, a predictive analytics company, where she was responsible for human capital development and management. Ms. Norris was a founding member of Opera Solutions, and served as a Principal from its founding until she assumed the position of Chief People Officer. Prior to Opera Solutions, Ms. Norris served as a Senior Vice President and was a founding member of Zeborg, Inc., and as a strategy consultant for A.T. Kearney and Mitchell Madison Group. Ms. Norris holds an MBA from Harvard Business School and a BA from Trinity College, where she was Phi Beta Kappa.

We believe Ms. Norris’ qualifications to serve as a director include her significant experience in defining and implementing corporate governance structures and growth strategies, and in developing and managing operational resources. Her experience of more than 15 years of providing consulting services to financial services, information technology and media, and office technology firms makes her a valuable advisor to our Board.

Arthur S. Sills has served as a director of the Company since October 1995. Mr. Sills was an educator and administrator in the Massachusetts school districts for 30 years prior to his retirement in 2000. Mr. Sills is the brother of Lawrence I. Sills and Peter J. Sills, and is the uncle of Eric Sills.

Mr. Sills holds an MEd from Hampton University and a BA from Colby College.

We believe Mr. Sills’ qualifications to serve as a director include his and his family’s significant ownership interest in the Company, which serves to align his interests with the interests of our other stockholders, his more than 15 years of experience as a director, his knowledge of the Company acquired over many years, and the fact that he represents the third generation of the Sills family which established the Company in 1919.

Peter J. Sills has served as a director of the Company since July 2004 and from December 2000 to May 2004. Mr. Sills is a writer and an attorney. Mr. Sills is the brother of Arthur S. Sills and Lawrence I. Sills, and is the uncle of Eric Sills. Mr. Sills holds a JD from Benjamin N. Cardozo School of Law and a BA from Trinity College.

We believe Mr. Sills’ qualifications to serve as a director include his and his family’s significant ownership interest in the Company, which serves to align his interests with the interests of our other stockholders, his knowledge and experience with the Company, which he acquired over many years, his legal background, and the fact that he represents the third generation of the Sills family which established the Company in 1919.1919.

Frederick D. Sturdivant has served as a director of the Company since December 2001. Mr. Sturdivant is a director of Dennen Steel, an independent consultant, and has servedserves as a Visitingan Adjunct Professor at the Warrington College of Business at the University of Florida since 2004.Florida. From 2000 to 2002, Mr. Sturdivant was Chairman of Reinventures LLC. From 1998 to 2000, he was Executive Managing Director of Navigant Consulting. From 1996 to 1998, he was President of Index Research and Advisory Services, a subsidiary of Computer Sciences Corporation. Previously, he served as a director of Fel-Pro, Inc., State Savings Bank, Columbus, and The Progressive Corporation. Mr. Sturdivant holds a PhD from Northwestern University, an MBA from the University of Oregon, and a BS from San Jose State. After completing his Ph.D.PhD at Northwestern University, Mr. Sturdivant held professorships at the University of Southern California, the University of Texas at Austin, the Harvard Business School, and an endowed chair at Ohio State University. We believe Mr. Sturdivant’s qualifications to serve as a director include his years of experience providing strategic advisory services to complex organizations in the areas of corporate strategy, marketing, management, information technology, distribution and environmental analysis. His knowledge of corporate strategy development and his organizational acumen provide valuable insight to our Board.

Richard S. Ward has served as a director of the Company since July 2004. Mr. Ward also serves as a member of the University of Virginia School of Law Business Advisory Council, the American Law Institute, the Association of General Counsel, and the Board of Trustees (Executive Committee) of the International College, of Beirut, Lebanon. Mr. Ward is a private investor and legal consultant. In 2000, Mr. Ward served as Chairman of the Large, Complex Case Committee of the American Arbitration Association. From 1969 to 1998, he served in various legal and managerial capacities at ITT Corporation, including Executive Vice President, General Counsel and Corporate Secretary, and served as a member of the ITT Management Committee. Previously, he served on the Boards of the American Arbitration Association, STC plc, a British telecommunications company, ITT Sheraton Corporation, First State Insurance Company, Boeing Industrial Technology Group Corporation, and Caesars World, Inc. Mr. Ward completed the Finance for Senior Executives program at Harvard Business School and holds an LLB from University of Virginia School of Law and a BSME from Yale University. Mr. Ward is a member of the Bars of New York and Virginia, and is admitted to practice before the U.S. Court of International Trade and the U.S. Court of Appeals for the Federal Circuit.

We believe Mr. Ward’s qualifications to serve as a director include his experience as an executiveexecutive officer of an international engineering and manufacturing company, and his legal and corporate governance expertise. His knowledge of the complex legal and governance issues facing multi-national companies and his understanding of what makes businesses work effectively and efficiently provide valuable insight to our Board.

Roger M. Widmann has served as a director of the Company since May 2005. Mr. Widmann also serves as a directorChairman of GigaBeam Corporation and Cedar Shopping Centers,Realty Trust, Inc. He currently serves as the, Chairman of Keystone National Group, (aa private equity fund of funds),funds, and a director of the March of Dimes of Greater New York, the Vice Chair of Oxfam America,America. He is a senior moderator of the Aspen Seminar at The Aspen Institute and the Liberty Fellowship (South Carolina), and a senior mentor of the Henry Crown Fellowship Program. From 1974Previously, Mr. Widmann served from 2007 to 2004, he previously served2011 as a director of GigaBeam Corporation, a telecommunications company, and before that time as a director and, most recently, as Chairman of the Board of Lydall, Inc., a manufacturing company, and from 1997 to 2004, he wasas a principal of Tanner & Co., Inc., an investment banking firm. Prior to that time, he wasfirm, and as the Senior Managing Director of Chemical Securities Inc. (now JPMorgan Chase Corporation). Mr. Widmann holds a JD from the Columbia Law School and an AB from Brown University.

We believe Mr. Widmann’s qualifications to serve as a director include his approximately 30 years experience in leading a manufacturing corporation as a director and Chairman and his experience as a principal of an investment banking firm. His demonstrated leadership capability and his extensive knowledge of complex financial and operational issues provide our Board with greater insight into the concerns of stockholders, investors, analysts and those in the financial community. The depth and breadth of his experience at such companies makes him a valuable advisor to our Board.

The Board of Directors recommends a vote “FOR” each of the nominees listed above.

AMENDMENTS TO THE STANDARD MOTOR PRODUCTS, INC.

2006 OMNIBUS INCENTIVE PLAN

General

We are asking our stockholders to approve amendments to the Standard Motor Products, Inc. 2006 Omnibus Incentive Plan (the “Plan”) to (a) increase the total number of shares of common stock available for award under the Plan from 700,000 to 1,900,000 shares and (b) clarify that the restriction in the Plan prohibiting the repricing of options and stock appreciation rights (SARs) without stockholder approval includes a prohibition on cash buyouts. In March 2011, our Board of Directors approved these amendments, subject to approval from our stockholders at the Annual Meeting. If the stockholders approve the amendments to the Plan, the amendments will be effective as of the date of the Annual Meeting. If the proposed amendments to the Plan are not approved, the Plan will continue as currently in effect until amended in accordance with its terms. The Company’s executive officers and directors have interests in this proposal.

The Plan was originally approved by our stockholders at the Company’s Annual Meeting on May 18, 2006. At that time, the Plan replaced our existing stock option plans and became the Company’s only plan for providing stock-based incentive compensation to our eligible employees, independent directors and other eligible persons.

Under the Plan, we currently are authorized to award up to an aggregate of 700,000 shares of common stock to our officers, directors, employees, advisors and consultants. As of December 31, 2010, there were 195,875 shares of common stock available for future grants under the Plan. The Board believes that the 195,875 shares currently available for future grants under the Plan are insufficient to meet our long-term incentive needs. If the Plan amendments are approved, we will have an aggregate of 1,395,875 shares available for future grants under the Plan, which the Board believes will be sufficient for a reasonable period.

Burn rate (also called run rate) measures a company’s pattern of granting equity awards as a percentage of total shares outstanding. It takes into consideration the type of equity award, such as stock options or restricted stock, and the volatility of the company’s stock price. ISS, which provides proxy advisory services to institutions and others, analyzes historic burn rates. Historic burn rates that exceed the average burn rate of the applicable peer industry by more than one standard deviation can result in an unfavorable vote recommendation from ISS. Our three-year average burn rate from 2008 to 2010 was 0.97%, which compares favorably to the ISS burn rate threshold for our industry of 3.25%.

If the Plan amendments are approved, Sections 4.1(a), 4.1(b) and 18.1 of the Plan would be amended to read in their entirety as follows:

“4.1Number of Shares Available for Awards.

| (a) | Subject to adjustment as provided in Section 4.4, the maximum number of Shares available for issuance to Participants under this Plan on or after the Effective Date shall be One Million Nine Hundred Thousand (1,900,000) Shares (the “Share Authorization”).

|

| (b) | The maximum number of Shares of the Share Authorization that may be issued pursuant to ISOs under this Plan shall be One Million Nine Hundred Thousand (1,900,000) Shares.

|

| 18.1 | Amendment, Modification, Suspension, and Termination. Subject to Section 18.3, the Committee may, at any time and from time to time, alter, amend, modify, suspend, or terminate this Plan and any Award Agreement in whole or in part; provided, however, that, without the prior approval of the Company’s stockholders and except as provided in Section 4.4, Options or SARs issued under this Plan will not be repriced, repurchased (including cash buyout), replaced, or regranted through cancellation, or by lowering the Option Price of a previously granted Option or the Grant Price of a previously granted SAR, and no material amendment of this Plan shall be made without stockholder approval if stockholder approval is required by law, regulation, or stock exchange rule.”

|

The Board believes that the Plan is essential to the Company’s continued success by enabling it to attract and retain officers, directors and employees of the highest caliber, by providing increased incentive for such persons to strive to attain the Company’s long-term goal of increasing stockholder value, and by continuing to promote the well being of the Company. The Plan, as amended, will enable the Company to continue to use the Plan to assist in recruiting, motivating and retaining talented employees to help achieve the Company’s business goals. Accordingly, our Board of Directors believes the Plan amendments are in our best interest and the best interest of our stockholders and recommends a vote “FOR” the amendments to the Plan.

The following is a brief summary of the material elements of the Plan as it is proposed to be amended. A copy of the Plan, as proposed to be amended, is included as Annex A to this proxy statement. The following summary is qualified in its entirety by reference to the Plan.

Purpose of Plan

The Plan will allow the Company, under the direction of the Compensation and Management Development Committee of the Board of Directors or those persons to whom administration of the Plan has been delegated or permitted by law (the “Committee”) (the Nominating and Corporate Governance Committee of the Board of Directors will make recommendations to the Committee concerning independent directors), to make grants of stock options, restricted stock awards, restricted stock units, stock appreciation rights, performance shares, cash-based awards and other stock-based awards to employees, directors, consultants, independent contractors, agents and advisors. The purpose of these stock awards is to attract and retain talented employees, directors and other eligible persons and further align their interests and those of our stockholders by continuing to link a portion of their compensation with the Company’s performance.

Key Terms

The following is a summary of the key provisions of the Plan.

Plan Term: | | May 18, 2006 to May 18, 2016 |

| | |

Eligible Participants: | | All of our employees, directors, consultants, independent contractors, agents and advisors are eligible to receive awards under the Plan, provided they render bona fide services to the Company. The Committee will determine which individuals will participate in the Plan. As of March 15, 2011, approximately 202 of our employees and directors were eligible to receive awards under the Plan, including twelve officers and six non-employee directors. |

| | |

Shares Authorized: | | 1,900,000, subject to adjustment to reflect stock splits and other corporate events or transactions. Shares subject to awards that are cancelled, forfeited or that expire by their terms will be returned to the pool of shares available for grant and issuance under the Plan. Of this amount, the maximum number of shares that may be issued to independent directors is one hundred fifty thousand (150,000) shares.

|

Award Types: | | (1) Non-qualified and incentive stock options; |

| | (2) Stock appreciation rights (SARs); |

| | (3) Restricted stock and restricted stock units; |

| | (4) Performance units and performance shares; |

| | (5) Cash-based awards; and |

| | (6) Other stock-based awards. |

| | |

Annual Share Limits on Awards: | | (a) Options: The annual maximum aggregate number of shares subject to options granted to any one person is twenty-five thousand (25,000).

(b) SARs: The annual maximum number of shares subject to stock appreciation rights granted to any one person is twenty-five thousand (25,000).

(c) Restricted Stock or Restricted Stock Units: The annual maximum aggregate grant with respect to awards of restricted stock or restricted stock units to any one person is ten thousand (10,000).

(d) Performance Units or Performance Shares: The annual maximum aggregate award of performance units or performance shares that a person may receive is ten thousand (10,000) shares, or equal to the value of ten thousand (10,000) shares determined as of the date of vesting or payout, as applicable.

(e) Cash-Based Awards: The annual maximum aggregate amount awarded or credited with respect to cash-based awards to any one person is the greater of two hundred fifty thousand dollars ($250,000) or the value of twenty-five thousand (25,000) shares determined as of the date of vesting or payout, as applicable.

(f) Other Stock-Based Awards: The annual maximum aggregate grant with respect to other stock-based awards to any one person is twenty-five thousand (25,000) shares.

(g) Independent director limits: The annual maximum aggregate grant with respect to awards to any independent director shall be five thousand (5,000) shares.

|

| | |

Vesting: | | Vesting schedules will be determined by the Committee when each award is granted. |

| | |

Award Terms: | | Each option granted shall expire at such time as the Committee shall determine at the time of grant but shall not be exercisable later than the tenth (10th) anniversary date of its grant. The term of any SAR granted shall be determined by the Committee but shall not be exercisable later than the tenth (10th) anniversary date of its grant.

|

| | |

Repricing, Replacing and Buyouts Prohibited: | | Repricing, replacing or repurchasing (including cash buyouts) a stock option or stock appreciation right is prohibited unless approved by stockholders. |

Terms applicable to Stock Options and Stock Appreciation Rights

The exercise price of stock options or stock appreciation rights granted under the Plan may not be less than the fair market value of our Common Stock on the date of grant. On April 8, 2011, the record date, the closing price of the Company’s Common Stock on the New York Stock Exchange was $13.84 per share. The term of these awards may not be longer than ten years. The Committee will determine at the time of grant the other terms and conditions applicable to such award, including vesting and exercisability.

Terms applicable to Restricted Stock Awards, Restricted Stock Unit Awards, Performance Shares and Other Stock-Based Awards

The Committee will determine the terms and conditions applicable to the granting of restricted stock awards, restricted stock unit awards, performance shares and other stock-based awards (including the grant of unrestricted shares). The Committee may make the grant, issuance, retention and/or vesting of restricted stock awards, restricted stock unit awards, performance shares and other stock-based awards contingent upon continued employment with the Company, the passage of time, or such performance criteria and the level of achievement versus such criteria as it deems appropriate.

Eligibility Under Section 162(m)

Awards may, but need not, include performance criteria that satisfy Section 162(m) of the Internal Revenue Code. To the extent that awards are intended to qualify as “performance-based compensation” under Section 162(m), the performance criteria may include among other criteria, one of the following criteria, either individually, alternatively or in any combination, applied to either the Company as a whole or to a business unit or subsidiary, either individually, alternatively, or in any combination, and measured either annually or cumulatively over a period of years, on an absolute basis or relative to a pre-established target, to previous years’ results or to a designated comparison group, in each case as specified by the Committee in the award:

| (a) | Net earnings or net income (before or after taxes); |

| (b) | Earnings per share (basic or diluted); |

| (c) | Net sales or revenue growth; |

| (e) | Return measures (including, but not limited to, return on assets, capital, invested capital, equity, sales, or revenue); |

| (f) | Cash flow (including, but not limited to, operating cash flow, free cash flow, cash flow return on equity, and cash flow return on investment); |

| (g) | Earnings before or after taxes, interest, depreciation, and/or amortization; |

| (h) | Gross or operating margins; |

| (j) | Share price (including, but not limited to, growth measures and total stockholder return); |

| (o) | Customer satisfaction; |

| (p) | Working capital targets; and |

| (q) | Economic value added or EVA® (net operating profit after tax minus the sum of capital multiplied by the cost of capital). |

To the extent that an award under the Plan is designated as a “performance award,” but is not intended to qualify as performance-based compensation under Section 162(m), the performance criteria can include the achievement of strategic objectives as determined by the Committee.

Notwithstanding satisfaction of any completion of any performance criteria described above, to the extent specified at the time of grant of an award, the number of shares of Common Stock, stock options or other benefits granted, issued, retainable and/or vested under an award on account of satisfaction of performance criteria may be reduced by the Committee on the basis of such further considerations as the Committee in its sole discretion determines.

Cash-based Awards

The Committee, at any time and from time to time, may grant cash-based awards to participants in such amounts and upon such terms as the Committee may determine. The Committee may establish performance goals in its discretion in connection with the grant of any cash-based awards.

Transferability

Except as otherwise provided in the Plan, awards granted under the Plan may not be sold, pledged, assigned, hypothecated, transferred or disposed of except by will or the laws of descent and distribution. No award may be made subject to execution, attachment or other similar process.

Administration

The Committee will administer the Plan. The Committee will select the persons who receive awards, determine the number of shares covered thereby, and, subject to the terms and limitations expressly set forth in the Plan, establish the terms, conditions and other provisions of the grants. The Committee may construe and interpret the Plan and prescribe, amend and rescind any rules and regulations relating to the Plan. The Committee may delegate to a committee of two or more directors or other persons the ability to grant awards to plan participants. In addition, the Committee may authorize one or more officers of the Company to do one or both of the following: (a) designate employees to be recipients of awards and (b) determine the size of any such awards; provided, however, (i) the Committee shall not delegate such responsibilities to any such officer for awards granted to an employee who is considered an insider (as defined in the Plan); (ii) the resolution providing such authorization sets forth the total number of awards such officer(s) may grant; and (iii) the officer(s) shall report periodically to the Committee regarding the nature and scope of the awards granted pursuant to the authority delegated.

The Committee may alter, amend, modify, suspend, or terminate the Plan and any related award agreement in whole or in part; provided, however, that, without the prior approval of the Company’s stockholders, options or SARs issued under the Plan will not be repriced, replaced or repurchased (including cash buyouts), or re-granted through cancellation, or by lowering the option price of a previously granted option or the grant price of a previously granted SAR, and no material amendment of the Plan shall be made without stockholder approval if stockholder approval is required by law, regulation, or stock exchange rule.

Adjustments

In the event of a stock dividend, recapitalization, stock split, reverse stock split, subdivision, combination, reclassification or similar change of the Company’s capital structure without consideration, the Committee may approve, in its discretion, an adjustment of the number and kind of shares available for grant under the Plan, and subject to the various limitations set forth in the Plan, the number of shares subject to outstanding awards under the Plan, and the exercise price of outstanding stock options and of other awards.

In the event of a merger or asset sale, any or all outstanding awards may be assumed or an equivalent award substituted by a successor corporation. In the event the successor corporation refuses to assume or substitute the awards outstanding under the Plan, the outstanding awards shall vest and become exercisable as to 100% of the shares subject thereto.

New Plan Benefits

The granting of awards under the Plan is discretionary, and we cannot now determine the number or type of awards to be granted in the future to any particular person or group. Therefore, it is not possible to determine the amount or form of any award that will be granted to any individual in the future. However, as part of their annual retainer, each independent director will receive on the date of the Annual Meeting an automatic restricted stock award of 1,000 shares. The benefits or amounts that were received by, or allocated to, the Chief Executive Officer, the other named executive officers, all current executive officers as a group, the current directors of the Company who are not executive officers as a group, and all employees, including all current officers who are not executive officers, as a group under the Plan for the fiscal year ended December 31, 2010 are set forth in the table below:

| Name and Position | | Dollar Value ($) | | | Number of Shares | |

Lawrence I. Sills Chairman and CEO | | $ | 39,240 | | | | 4,000 | |

John P. Gethin President and COO | | $ | 36,788 | | | | 3,750 | |

James J. Burke Vice President Finance and CFO | | $ | 36,788 | | | | 3,750 | |

Dale Burks Vice President Temperature Control Division | | $ | 88,375 | | | | 7,500 | |

Carmine J. Broccole Vice President General Counsel and Secretary | | $ | 88,375 | | | | 7,500 | |

| Executives Group | | $ | 680,360 | | | | 60,000 | |

Non-Executive Director Group | | $ | 47,640 | | | | 6,000 | |

Non-Executive Officer Employee Group | | $ | 1,132,795 | | | | 107,025 | |

U.S. Tax Consequences

The following is a general summary as of the date of this proxy statement of the United States federal income tax consequences to the Company and participants in the Plan. The federal tax laws may change and the federal, state and local tax consequences for any participant will depend upon his or her individual circumstances. Each participant is encouraged to seek the advice of a qualified tax advisor regarding the tax consequences of participation in the plan.

Non-Qualified Stock Options

A participant will realize no taxable income at the time a non-qualified stock option is granted under the plan, but generally at the time such non-qualified stock option is exercised, the participant will realize ordinary income in an amount equal to the excess of the fair market value of the shares on the date of exercise over the stock option exercise price. Upon a disposition of such shares, the difference between the amount received and the fair market value on the date of exercise will generally be treated as a long-term or short-term capital gain or loss, depending on the holding period of the shares. The Company will generally be entitled to a deduction for federal income tax purposes at the same time and in the same amount as the participant is considered to have realized ordinary income in connection with the exercise of the non-qualified stock option.

Incentive Stock Options

A participant will realize no taxable income, and the Company will not be entitled to any related deduction, at the time any incentive stock option is granted. If certain employment and holding period conditions are satisfied, then no taxable income will result upon the exercise of such option and the Company will not be entitled to any deduction in connection with the exercise of such stock option. Upon disposition of the shares after expiration of the statutory holding periods, any gain realized by a participant will be taxed as long-term capital gain and any loss sustained will be long-term capital loss, and the Company will not be entitled to a deduction in respect to such disposition. While no ordinary taxable income is recognized at exercise (unless there is a “disqualifying disposition,” see below), the excess of the fair market value of the shares over the stock option exercise price is a preference item that is recognized for alternative minimum tax purposes.

Except in the event of death, if shares acquired by a participant upon the exercise of an incentive stock option are disposed of by such participant before the expiration of the statutory holding periods (i.e., a “disqualifying disposition”), such participant will be considered to have realized as compensation, taxed as ordinary income in the year of such disposition, an amount not exceeding the gain realized on such disposition, equal to the difference between the stock option price and the fair market value of such shares on the date of exercise of such stock option. Generally, any gain realized on the disposition in excess of the amount treated as compensation or any loss realized on the disposition will constitute capital gain or loss, respectively. If a participant makes a “disqualifying disposition,” generally in the fiscal year of such “disqualifying disposition” the Company will be allowed a deduction for federal income tax purposes in an amount equal to the compensation realized by such participant.

Stock Appreciation Rights

A grant of a stock appreciation right (which can be settled in cash or the Company Common Stock) has no federal income tax consequences at the time of grant. Upon the exercise of stock appreciation rights, the value received is generally taxable to the participant as ordinary income, and the Company generally will be entitled to a corresponding tax deduction.

Restricted Stock

A participant receiving restricted stock may be taxed in one of two ways: the participant (i) pays tax when the restrictions lapse (i.e., they become vested) or (ii) makes a special election to pay tax in the year the grant is made. At either time the value of the award for tax purposes is the excess of the fair market value of the shares at that time over the amount (if any) paid for the shares. The Company receives a tax deduction at the same time and for the same amount taxable to the participant. If a participant elects to be taxed at grant, then, when the restrictions lapse, there will be no further tax consequences attributable to the awarded stock until the participant disposes of the stock.

Restricted Stock Units

In general, no taxable income is realized upon the grant of a restricted stock unit award. The participant will generally include in ordinary income the fair market value of the restricted stock units at the time they are settled. The Company generally will be entitled to a tax deduction at the same time and in the same amount that the participant recognizes ordinary income.

Performance Shares

The participant will not realize income when a performance share is granted, but will realize ordinary income when shares are transferred to him or her. The amount of such income will be equal to the fair market value of such transferred shares on the date of transfer. The Company will be entitled to a tax deduction at the same time and in the same amount as the participant recognizes ordinary income as a result of the transfer of shares.

Section 162(m) Limit

The Plan is intended to enable the Company to provide certain forms of performance-based compensation to executive officers that will meet the requirements for tax deductibility under Section 162(m) of the Internal Revenue Code. Section 162(m) provides that, subject to certain exceptions, the Company may not deduct compensation paid to any one of certain executive officers in excess of $1 million in any one year. Section 162(m) excludes certain performance-based compensation from the $1 million limitation.

Cash-Based Awards and Other Stock-Based Awards

The participant will recognize, as a general rule, ordinary income at the time of payment of cash or delivery of actual shares of Common Stock. Future appreciation on shares of Common Stock held beyond the ordinary income recognition event will be taxable at capital gains rates when the shares of Common Stock are sold. The Company, as a general rule, will be entitled to a tax deduction that corresponds in time and amount to the ordinary income recognized by the participant, and the Company will not be entitled to any tax deduction in respect of capital gain income recognized by the participant.

The Board of Directors recommends a vote “FOR” the approval of the amendments to the Standard Motor Products, Inc. 2006 Omnibus Incentive Plan.

PROPOSAL 3

The Audit Committee of our Board of Directors plans to appoint KPMG LLP (“KPMG”) as the Company’s independent registered public accounting firm to audit the Company’s consolidated financial statements for the

20112014 fiscal year. Although the Company is not required to seek stockholder approval of this appointment, the Board believes it to be sound corporate governance to do so and is asking stockholders to ratify the appointment of KPMG. If the appointment is not ratified, the Audit Committee will investigate the reasons for stockholder rejection and will reconsider the appointment. Representatives of KPMG are expected to attend the Annual Meeting where they will be available to respond to questions and, if they desire, to make a statement.

The Board of Directors recommends a vote “FOR” the ratification of KPMG LLP as the Company’s independent registered public accounting firm.

The following table presents fees for professional services rendered by KPMG in the fiscal

year ended December 31, 2010 and by Grant Thornton LLP, our prior auditors (“Grant Thornton”), for the fiscal years ended December 31,

20102013 and

2009:2012.

| | | 2010 | | | 2009 | | |

| | | KPMG | | | Grant Thornton(3) | | | Grant Thornton | | | 2013 | | | 2012 | |

| Audit fees | | $ | 900,000 | | | $ | 351,590 | | | $ | 1,713,192 | | | $ | 1,275,400 | | | $ | 1,037,000 | |

Audit-related fees(1) | | | ¾ | | | | 84,353 | | | | 215,318 | | | | 136,000 | | | | 99,000 | |

Tax fees(2) | | | 180,500 | | | | ¾ | | | | 36,541 | | | | 395,400 | | | | 323,000 | |

| All other fees | | | ¾ | | | | ¾ | | | | ¾ | | | ─ | | | ─ | |

| Total | | $ | 1,080,500 | | | $ | 435,943 | | | $ | 1,965,051 | | | $ | 1,806,800 | | | $ | 1,459,000 | |

| (1) | Audit-related fees consistedconsist principally of audits of financial statements of certain employee benefit plans. |

| (2) | Tax fees consist primarily of U.S. and international tax compliance and planning. |

(3) | On August 27, 2010, the Audit Committee of our Board of Directors approved the dismissal of Grant Thornton as the Company’s independent registered public accounting firm. The Company informed Grant Thornton of its dismissal on August 30, 2010. |

In accordance with its charter, the Audit Committee approves the compensation and terms of engagement of the Company’s independent auditors, including the pre-approval of all audit and non-audit service fees. All of the fees paid to the Company’s independent auditors described above were for services pre-approved by the Audit Committee.

Grant Thornton LLP9

Grant Thornton’s reports on the consolidated financial statements of the Company for the fiscal years ended December 31, 2009 and 2008 contained no adverse opinion or disclaimer of opinion, and were not qualified or modified as to uncertainty, audit scope or accounting principles. During the Company’s two most recent fiscal years ended December 31, 2009 and 2008 and from January 1, 2010 through August 30, 2010, (a) there were no disagreements with Grant Thornton on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Grant Thornton, would have caused it to make reference to the subject matter of the disagreements in its reports on the consolidated financial statements of the Company for such years; and (b) there were no reportable events as defined in Item 304(a)(1)(v) of Regulation S-K.

KPMG LLP

On August 27, 2010, the Audit Committee approved the engagement of KPMG as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2010. During the Company’s two most recent fiscal years ended December 31, 2009 and 2008 and from January 1, 2010 through August 30, 2010, neither the Company nor anyone on its behalf consulted KPMG regarding either (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s consolidated financial statements, and no written report or oral advice was provided to the Company that KPMG concluded was an important factor considered by the Company in reaching a decision as to the accounting, auditing or financial reporting issue; or (ii) any matter that was the subject of a disagreement or reportable event as defined in Regulation S-K, Item 304(a)(1)(iv) and Item 304(a)(1)(v), respectively.

During the two years ended December 31, 2009 and 2008 and from January 1, 2010 through the engagement of KPMG as the Company’s independent registered public accounting firm, KPMG had been engaged by the Company to provide the Company with tax services, including routine tax advice and consulting services in connection with the preparation of the Company’s tax returns, as well as the review of the Company’s quarterly tax provision calculations and transfer pricing policies. In approving the selection of KPMG as the Company’s independent registered public accounting firm, the Audit Committee considered these services previously provided by KPMG and concluded that such services would not adversely affect the independence of KPMG.

ADVISORY VOTE ON THE COMPENSATION

OF OUR NAMED EXECUTIVE OFFICERS

SEC rules adopted pursuant to the recently enacted Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, or the Dodd-Frank Act, enable our stockholders to vote, on an advisory (non-binding) basis, at the Annual Meeting to approve the compensation of our named executive officers, as disclosed in this proxy statementProxy Statement (referred to as a “say-on-pay” vote). The stockholder vote on executive compensation is an advisory vote only, and it is not binding on the Company or the Board of Directors. Although the vote is non-binding, the Board values the opinions of our stockholders and will consider the outcome of the vote when making future compensation decisions as it deems appropriate.

As described more fully in the “Compensation Discussion and Analysis” section, at pages 33 to 46beginning on page 25 of this proxy statement,Proxy Statement, our executive compensation program is designed to attract, motivate and retain individuals with the skills required to formulate and drive the Company’s strategic direction and achieve annual and long-term performance goals necessary to create stockholder value, while striving to avoid the use of highly leveraged incentives that may encourage overly risky short-term behavior on the part of executives. We believe that our executive compensation program is reasonable and competitive and focused on pay for performance principles.

Our Compensation and Management Development Committee establishes, recommends and governs all of the compensation and benefits policies and actions for the Company’s named executive officers. We utilize a combination of base pay, annual incentives and long-term incentives. While we have generally targeted base pay to be in the median to 75% range, and each other component of executive compensation to be at or near the median range of similar-type compensation for our peer group, actual compensation of our named executive officers varies depending upon the achievement of pre-established performance goals, both individualcorporate and corporate.individual. The annual incentive payout is based both on company-wide and/or business segment operating financial performance (our EVA bonus) as well as individual performance goals (our MBO or management by objective bonus), and it is limited to an annual payout of 200% of the target opportunity. Through stock ownership requirements and equity incentives, we also align the interests of our executives with those of our stockholders and the Company’s long-term interests. Our executive compensation policies have enabled us to attract and retain talented and experienced executives and have benefited the Company over time. We believe that the fiscal year 20102013 compensation of each of our named executive officers was reasonable and appropriate and aligned with the Company’s fiscal year 20102013 results and achievement of the objectives of our executive compensation program.

The Company also has several governance policies in place to align executive compensation with stockholder interests and mitigate risks in its plans. These programs include stock ownership guidelines, limited perquisites, use of tally sheets, and a claw back policy.

10

For the reasons discussed above, the Board of Directors unanimously recommends that stockholders vote in favor of the following non-binding resolution:

“RESOLVED, that the stockholders hereby APPROVE, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K and the other compensation disclosure rules of the Securities and Exchange Commission in the Company’s Proxy Statement for the 20112014 Annual Meeting of Stockholders (which disclosure includes the Compensation Discussion and Analysis, the Summary Compensation Table for 20102013 and other related tables and accompanying narrative).”

The Board of Directors recommends a vote “FOR” the approval of the non-binding, advisory resolution approving the compensation of our named executive officers.

PROPOSAL 5

ADVISORY VOTE ON THE FREQUENCY OF ASTOCKHOLDER VOTE ON THE COMPENSATION

OF OUR NAMED EXECUTIVE OFFICERS

The Dodd-Frank Act also requires that, not less frequently than once every six years, we enable our stockholders to vote to approve, on an advisory (non-binding) basis, the frequency (every one, two or three years) with which the non-binding, advisory stockholder vote to approve the compensation of our named executive officers should be conducted in the future. In accordance with those rules, we are requesting that you vote to advise us as to whether you believe future votes to approve the compensation of our named executive officers should occur every one, two or three years, or whether you wish to abstain from voting on this proposal.

The enclosed proxy card gives you four choices for voting on this item. You can choose whether the “say-on-pay” vote should be conducted every year, every two years or every three years. You may also abstain from voting on this item. Note that stockholders are not voting to approve or disapprove the recommendation of the Board regarding this proposal. You are being asked only to express your preference for a one, two or three year frequency or to abstain from voting.

Consistent with the Company’s compensation philosophy, the Company’s executive compensation program promotes a performance-based culture and is designed to award superior performance and attract and retain highly-qualified executives while aligning their interests with those of the Company’s stockholders. Equity comprises a significant component of the named executive officers’ compensation and such long-term awards generally vest over a three-year period from the date of grant. Additional grants of restricted stock vest over a longer period of time until a participant reaches 60, 63 and 65 years of age to ensure retention. The Company believes these factors, along with the rest of the compensation program as described more fully below in the “Compensation Discussion and Analysis” and “Summary Compensation Table for 2010” sections of this proxy statement and the related tables and narrative disclosure, emphasize the positive pay practices employed by the Company.

The Board of Directors believes that an advisory stockholder vote on executive compensation every THREE YEARS is the best approach for the Company and its stockholders for a number of reasons, including the following:

| · | The Company’s primary restricted stock awards are based on a three-year vesting period. Additionally, in 2010 the Company granted restricted stock awards that vest in increments when a participant reaches the ages of 60 (25% vests), 63 (25% vests) and 65 (balance vests). |

| · | The Company’s performance share awards are based on a three-year performance period. In order for the performance shares to be earned, the Company must achieve a certain level of earnings from continuing operations before taxes, excluding special items, cumulatively at the end of the three-year performance period covered by the award. |

| · | A three-year cycle will provide our stockholders with sufficient time to fully assess the effectiveness of the Company’s short-term and long-term incentive programs and compensation strategies with the hindsight of three years of corporate performance. |

| · | A three-year cycle provides the Board of Directors with sufficient time to evaluate and respond to stockholder input and thoughtfully consider whether to implement any changes to the Company’s executive compensation program. |

While the result of this advisory vote on the frequency of the vote on executive compensation is non-binding, the Board values the opinions of our stockholders. Accordingly, our Board will consider the outcome of the vote and those opinions when deciding how frequently to conduct the vote on executive compensation.

The Board of Directors recommends that you vote to hold the advisory vote on executive compensation EVERY THREE YEARS.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of the Company’s Common Stock as of March 15, 2011April 4, 2014 by:

| · | each person known by the Company to own beneficially more than five percent of the Company’s Common Stock; |

| · | each director and nominee for director of the Company; |

| · | our principal executive officer, principal financial officer, and each of our three other most highly compensated executive officers named in the Summary Compensation Table below; and |

| · | all directors and executive officers as a group. |

| Name and Address | | Amount and Nature of Beneficial Ownership(1) | | | Percentage of Class | | | Amount and Nature of Beneficial Ownership (1) | | | | Percentage of Class | |

| GAMCO Investors, Inc. | | | 2,906,409 | (2) | | | 12.7 | % | |

| One Corporate Center | | | | | | | | | |

| Rye, NY | | | | | | | | | |

| Royce & Associates, LLC | | | | 2,927,580 | | (2) | | | 12.5 | % |

| 745 Fifth Avenue | | | | | | | | | | |

| New York, NY 10151 | | | | | | | | | | |

| BlackRock, Inc. | | | 1,658,002 | (3) | | | 7.3 | % | | | 1,757,739 | | (3) | | | 7.5 | % |

| 40 East 52nd Street | | | | | | | | | | | | | | | | | |

| New York, NY 10022 | | | | | | | | | | | | | | | | | |

| Dimensional Fund Advisors Inc. | | | 1,558,185 | (4) | | | 6.8 | % | |

| 1299 Ocean Avenue | | | | | | | | | |

| Santa Monica, CA | | | | | | | | | |

| FMR LLC | | | | 1,553,801 | | (4) | | | 6.6 | % |

| 245 Summer Street | | | | | | | | | | |

| Boston, MA 02210 | | | | | | | | | | |

| Dimensional Fund Advisors LP | | | | 1,504,322 | | (5) | | | 6.4 | % |

| Palisades West, Bldg. One | | | | | | | | | | |

| 6300 Bee Cave Road | | | | | | | | | | |

| Austin, TX 78746 | | | | | | | | | | |

| Peter J. Sills | | | | 1,297,645 | | (6) | | | 5.5 | % |

| Arthur S. Sills | | | 1,291,578 | (5) | | | 5.7 | % | | | 1,295,942 | | (7) | | | 5.5 | % |

| Peter J. Sills | | | 1,278,045 | (6) | | | 5.6 | % | |

| Lawrence I. Sills | | | 860,512 | (7) | | | 3.8 | % | | | 746,984 | | (8) | | | 3.2 | % |

| Eric Sills | | | | 156,623 | | | | | * | |

| Richard S. Ward | | | | 64,113 | | (9) | | | * | |

| William H. Turner | | | | 64,073 | | | | | * | |

| Roger M. Widmann | | | | 53,230 | | | | | * | |

| James J. Burke | | | | 52,629 | | | | | * | |

| Pamela Forbes Lieberman | | | | 45,702 | | | | | * | |

| Dale Burks | | | | 39,246 | | | | | * | |

| John P. Gethin | | | 52,281 | (8) | | | * | | | | 36,653 | | | | | * | |

| Robert M. Gerrity | | | 28,273 | (9) | | | * | | |

| William H. Turner | | | 58,090 | (10) | | | * | | |

| James J. Burke | | | 51,567 | (11) | | | * | | |

| Frederick D. Sturdivant | | | 48,148 | (12) | | | * | | | | 29,049 | | | | | * | |

| Richard S. Ward | | | 49,294 | (13) | | | * | | |

| Roger M. Widmann | | | 43,729 | (14) | | | * | | |

| Dale Burks | | | 36,248 | (15) | | | * | | |

| Pamela Forbes Lieberman | | | 32,701 | | | | * | | |

| Carmine J. Broccole | | | 17,360 | (16) | | | * | | |

| Directors and Officers as a group (20 persons) | | | 3,311,658 | (17) | | | 14.4 | % | |

| Joseph W. McDonnell | | | | 5,243 | | | | | * | |

| Alisa C. Norris | | | | 5,243 | | | | | * | |